The Middle East Market consumed 8 million MT of oils and fats annually. The consumption basket is divided among various oils, but sunflower, palm oil and soybean oil accounted for 76% of the total oils and fats consumed in the region. The remaining 24% are shared by butterfat, rapeseed oil, cotton oil, corn, olive and others. The region is very dependent on imports of oils and fats to meet its domestic requirement.

The consumption pattern is influenced by the availability of oil as well as their diet. Sunflower and soybean are mostly available on supermarket shelves for home and food industry use. Palm oil is mostly consumed in the food industry sector, mainly for bakery and confectionery products, margarine and vegetable ghee, frying snacks and various others. A growing number of HORECA industry has also boosted the offtake of palm oil in the region. Price competitiveness relative to sunflower and soybean oil attracts manufacturers to use palm oil for their food processing industries.

In terms of perception towards palm oil, it varies among the consumers’ groups. In general, it is still perceived as unhealthy oils due to its high saturate fat level, even though it has a balanced composition between saturated and unsaturated fat.

Since palm oil is not seen as a threat to the domestic oils and fats industry, there is no organized anti-palm oil campaign and it is not done openly. However, there are few occasions where palm oil is being ‘bullied’.

The ‘no palm oil’ label mooted by the Europeans has been picked up by food manufacturers in Turkey and Iran. The intention is to capture targeted segments of the market, but it affects palm oil image negatively.

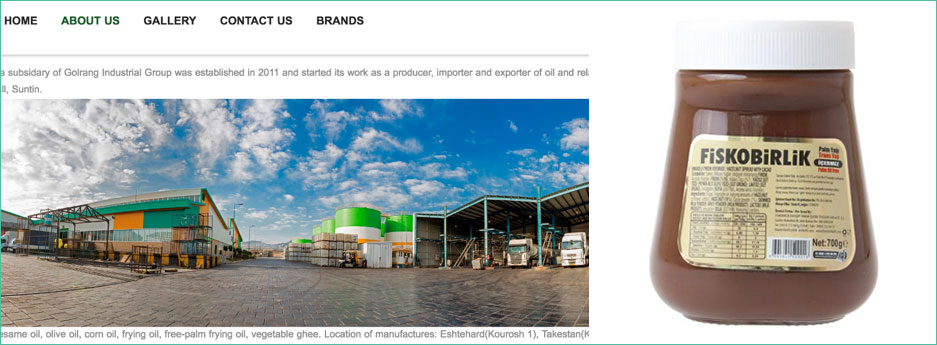

A local company in Turkey has labelled its chocolate spread with ‘no palm oil’ labeling to capture a market niche over Nutella. However, the action is against Turkish Food Guidelines which prohibits such labeling, especially when the ingredients is not part of the said product’s ingredients. While the aim of such regulation to protect consumers from being misled, the general sentiments of Turkish consumers towards palm oil are still not favorable.

In keeping up with the current consumer trend, an Iranian company started the ‘no palm oil’ labeling to be perceived as a ‘responsible companies’.

In 2018, the Saudi Food and Drugs Authority has implemented banned on partially hydrogenated oils in the food industry. The food industry players were given two years to adhere to the new rulings and the regulation has taken effect this year. Other markets such as Iran has introduced TFA limits, whereas UAE will apply the banned effective in 2023 (Food Navigator, 29 January 2020)

Iran has also restricted the use of hydrogenated oils and the moves have shifted the demands to palm oil. However, there is concern over the high level of saturated fat content in palm oil as well as 3-MCPD contamination which affected human health. The Iranian Food and Drug Administration encouraged food industries to use other soft oils such as sunflower and canola to reduce saturated fat levels.

While the ban on trans-fat is to palm oil advantage and could garner better position over the replacement of partially hydrogenated vegetable oils with palm oil, there is still biased opinion about palm oil being unhealthy and the least preferred vegetable oil.

Generally, consumers do not have a very good understanding of food science and the subject of oils and fats is very complicated. They have preconceived ideas on a certain types of vegetable oils and they are influenced by what is being brought to them through advertisement, information available from print and electronic media and nowadays, social media platform.

Therefore MPOC approached to correct this misconception is through an educational program, a series of technical marketing programs to provide a proper guidelines for the technical aspects of palm oil. Besides that, all claims against palm oil have been challenged through scientific research and evidence. Consumers are made aware that it is safe to consume palm oil and without them realizing it, palm oil is already in most of food items, 20% is used in consumers good such as personal care products, cosmetics and 5% is for energy use. It is the versatile oils and competitively priced.

Palm oil will continue to supplement the requirement of oils and fats globally and especially in the Middle East market. Palm oil will complement the needs of the region and the answer to their food security issues.

Prepared by Fatimah Zaharah

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.